By Erica Furfaro & Margaret Vitrano

Market and Performance Overview

Equities surged in the third quarter, continuing their post-Liberation Day rebound, with the S&P 500 Index up 8.1% and tech-heavy Nasdaq Composite rising 11.2% to record highs. Investor optimism was fueled by better-than-feared tariff outcomes, the passing of the One Big Beautiful Bill Act in July, anticipated interest rate cuts — the Federal Reserve cut 25 bps cut in September and signaled further easing — and robust corporate earnings, particularly in technology and the Magnificent Seven.

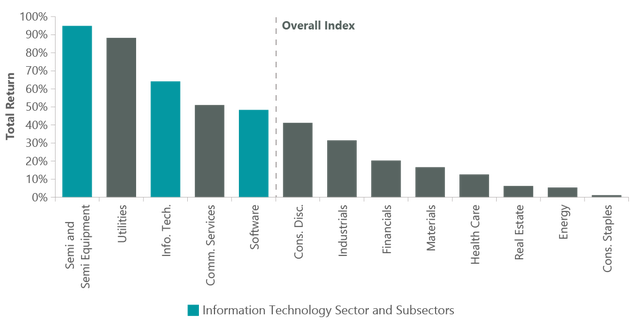

The benchmark Russell 1000 Growth Index rose 10.5% for the quarter and is up 46.7% from its early April lows in the aftermath of Liberation Day. A significant theme since then has been exuberance around AI and divergence between “AI winners” and “AI losers.” AI winners, consisting primarily of cloud providers, chip makers and certain infrastructure software companies (as well as utilities powering data centers), have rallied even more strongly from the April lows — with some stocks up over 100% — while capital has flowed out of perceived AI laggards in areas like application software and services. Widening dispersion has been accompanied by a broadening out of perceived AI losers from companies directly threatened in the near to intermediate term to include those potentially exposed but unlikely to be challenged for years to come.

Exhibit 1: Russell 1000 Growth Index Since Liberation Day

Performance from index lows on Apr. 8, 2025 through Sept. 30, 2025. Source: FactSet. Note: Utilities performance represents three stocks comprising 0.30% of the index.

While the ClearBridge Large Cap Growth Strategy has delivered solid absolute performance from the April lows, it has underperformed the benchmark due to underexposure to perceived AI winners (Broadcom (AVGO), Oracle (ORCL), not owning Palantir Technologies) as well as holding several names deemed by investors to be AI losers (Workday (WDAY), Salesforce (CRM), Accenture (ACN)). We made several adjustments to the portfolio in these areas during the third quarter as explained further below. As long-term growth investors with a three-to-five-year time horizon for our portfolio companies, we remain balanced in a growth market moving to more exuberant levels. While acknowledging both the euphoria among so-called winners and gloom around so-called losers, we are not chasing momentum but adding new AI-indexed growth ideas in a disciplined way.

Portfolio Positioning

During the quarter, the Strategy initiated new positions in infrastructure software providers Oracle and Datadog (DDOG) and added to custom silicon developer Broadcom. Oracle, a leading provider of database software for large enterprises, has successfully expanded into cloud infrastructure as a platform to run generative AI workloads. Oracle is gaining share among hyperscalers due to its lower-cost data center architecture, which is well-suited for large-scale AI training workloads. We believe Oracle’s share of the market will continue to grow over the next few years with profitability of this growth underappreciated by the market.

“We are not chasing momentum but adding new AI-indexed growth ideas in a disciplined way.”

Datadog operates a monitoring, observability and data security platform for cloud applications. Observability is a large and growing end market with penetration rising as use and complexity of applications grow, requiring more performance monitoring. Datadog is a leader in cloud application monitoring, offering ease of use, breadth and scalability superior to its competitors. We believe large language model (LLM) observability, a rapidly growing market due to the acceleration of Gen AI workloads, creates a new vector for growth not reflected in fundamental estimates. Datadog’s mission critical offering and rapid innovation should support attractive >20% revenue growth with an attractive valuation as the company further scales margin and cash flow.

We exited positions in Workday and Accenture, lowering our exposure to application software providers given decelerating fundamental growth and growing risks around AI. Workday continues to see core organic growth slow, particularly in the human capital management segment, and has yet to develop a comprehensive suite of AI tools needed to support pricing and incremental growth opportunities. The sale of Accenture, a global professional services company helping clients build digital infrastructure, was driven by growing concerns that growth in Accenture’s consulting business from AI is being offset by a still-muted aggregate tech spending environment and demand in the outsourcing business. Meanwhile, we have trimmed but still maintain a position in Salesforce in application software.

The health care sector is facing a myriad of questions around underlying spending levels, tariff concerns and regulatory risks. After trimming managed care provider UnitedHealth Group (UNH) regularly over the last three quarters, we fully exited the position in July following remarks from returning CEO Stephen Helmsley about a turnaround plan that indicated the path to recovery will be protracted. Ongoing uncertainty impacting pharmaceutical companies, as well as our more muted view of the GLP-1 market, prompted the sale of leading diabetes and obesity franchises Eli Lilly (LLY) and Novo Nordisk (NVO). These companies also continue to face competition from lower-priced compounders that we had expected to abate. We upgraded our biopharmaceutical exposure with the purchase of Vertex Pharmaceuticals, a high-quality biotech with a leading franchise in cystic fibrosis. We have been following the company for some time and see its pain treatments as its next big opportunity. Some disappointments in the timing of clinical trials for chronic pain enabled us to establish a position at what we view as a moderate valuation relative to its pipeline.

Another area where we see promise is in early cyclical companies that could be beneficiaries of an improving economic environment. We repurchased Chipotle Mexican Grill, which is coming off a period of relatively weaker sales we view as more macro than execution related, increased our Starbucks (SBUX) position and added Parker-Hannifin, a diversified manufacturer in industrials. One of Parker-Hannifin’s (PH) two main segments is aerospace, a resilient growth area in an otherwise challenged economy. We have been optimistic about the durability of growth in aerospace as expressed through portfolio holdings RTX (RTX) and Airbus (OTCPK:EADSF)(OTCPK:EADSY). Parker-Hannifin is also exposed to short-cycle industrial businesses where orders are rebounding. While it is still too early to definitively call a positive inflection in the industrial economy, we see green shoots here and want portfolio exposure to improving trends.

“We see promise in early cyclical companies that could be beneficiaries of an improving economic environment.”

The purchase was partially funded with proceeds from the sale of Union Pacific. We believe the merger between Union Pacific (UNP) and Norfolk Southern (NSC) will create an overhang on the cargo rail operator for some time, limiting the upside potential. Without a stronger freight environment, an area that has been in a multi-year recession, we do not expect the combined company will benefit as much from an expected industrials recovery.

Outlook

Momentum remains strong and valuations high across the large cap market, most notably among growth stocks. We have purposely positioned the ClearBridge Large Cap Growth Strategy as an all-weather portfolio that seeks to deliver consistent results through the business cycle. When the Russell 1000 Growth Index compounds at its historical average of 11.9%,1 the Strategy has shown an ability to outperform. We also have a track record of strong downside capture during challenged market environments as demonstrated in the first quarter of this year. Due to our focus on diversification and risk management, however, we tend to lag the benchmark in higher-return, beta-driven momentum periods like the current one.

Despite the near-term performance challenges, nothing has changed in our investment approach or management of the portfolio. We have always tried to buy names at attractive entry points, using our long-term orientation to take advantage of periods of volatility like the aftermath of Liberation Day. We also remained focused on valuations and cognizant of position sizes, trimming winners into strength like we did with Netflix (NFLX) and Intuitive Surgical (ISRG) earlier this year. We continue to lean on our three growth buckets framework with the core of the portfolio in reasonably priced stable growth companies that compound earnings over time, supported by higher growth select names gaining share through innovation and cyclical growers with turnaround potential or direct exposure to economic activity. Looking ahead to 2026, we are optimistic but also cautious. While AI winners continue to dominate market attention, the ClearBridge Large Cap Growth Strategy is prepared for a range of scenarios, including stagflation or a rate-cutting rally.

Portfolio Highlights

The ClearBridge Large Cap Growth Strategy underperformed its Russell 1000 Growth Index benchmark in the third quarter. On an absolute basis, the Strategy delivered positive contributions across six of the nine sectors in which it was invested (out of 11 sectors total). The primary contributor to performance was the IT sector while the health care and financials sectors were the main detractors.

Relative to the benchmark, overall stock selection and sector allocation detracted from performance. In particular, stock selection in the IT, communication services, health care, consumer discretionary and financials sectors, an underweight to IT and an overweight to financials detracted from performance. On the positive side, stock selection in and an underweight to the consumer staples sector contributed to performance.

On an individual stock basis, the primary detractors from relative performance for the quarter were Apple (AAPL), Netflix, Alphabet (GOOG)(GOOGL), Intuitive Surgical and Intuit (INTU). The leading contributors to relative returns were Eli Lilly, Microsoft (MSFT), Taiwan Semiconductor (TSM) and not holding Costco Wholesale (COST) and Mastercard (MA).

In addition to the transactions mentioned above, we initiated a position in Fair Isaac (FICO) in the IT sector and closed a position in Zoetis (ZTS) in the health care sector.

Erica Furfaro, Portfolio Manager

Margaret Vitrano, Portfolio Manager

|

1 Annualized total return since inception on Jan. 1, 1987. Source: FactSet. Past performance is no guarantee of future results. Copyright © 2025 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies. “Russell®” is a trade mark of the relevant LSE Group companies and is/are used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. Performance source: Internal. Benchmark source: Standard & Poor’s. |

Original Post

Read the full article here