Summary

- MasterBrand is North America’s largest residential kitchen and bath cabinet manufacturer, serving new home construction and R&R markets with a diverse product range.

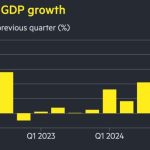

- MBC has shown strong growth, with sales and EBITDA CAGRs of 11% and 17% (2019-2022), and significant margin expansion despite market challenges.

- Management focuses on growth investment and balance sheet fortification, aiming for a net debt to EBITDA ratio below 2x by end of 2025.

- MBC offers a compelling valuation with an EV/EBITDA multiple of 6.7x and a 14% trailing twelve-month free cash flow yield, promising nearly 80% upside.

What the Company Does

|

As of 4/15/25 |

|

|

Market Capitalization |

$1.5B |

|

Enterprise Value |

$2.4B |

|

Price |

$11.57 |

MasterBrand (NYSE:MBC) is the largest manufacturer of residential kitchen and bath cabinets in North America, primarily

This article was written by

Single stock ideas excerpted from fund letters published by Seeking Alpha.

Read the full article here

News Room