Realty Income Corporation (NYSE:O) seems to have changed its goals. No longer is it just sustainable growth; the company seems desperate for as much growth as possible. That’s concerning, as it means the company’s margins and what’s helped it for the long term is declining. Despite that, there is a price where we feel the company is a strong long-term investment.

Realty Income Overview

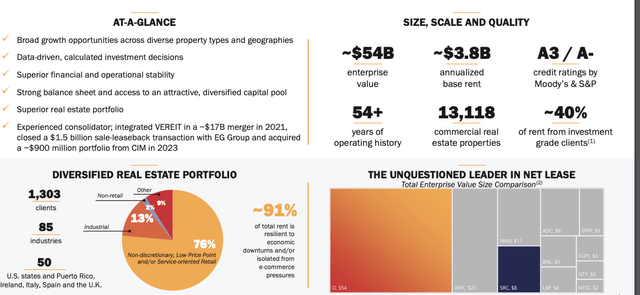

The company has a strong portfolio of assets.

Realty Income Investor Presentation

Its enterprise value is $54 billion above, but with the acquisition, it’s dropped. Its annualized base rent is $3.8 billion, and the company has strong A3 / A- credit ratings. The company has more than 50 years of operating performance and an incredibly strong and diversified portfolio with more than 13000 commercial properties.

The company only earns 40% of its rent from investment-grade clients, but its diversification helps it significantly. The company has dealt with large acquisitions before, and we expect it’ll be able to handle the acquisition of Spirit Realty Capital, Inc., but it still has massive risks.

Realty Income Spirit Realty Transaction

The company is making what we believe to be an unintelligent move, an acquisition of Spirit Realty that might barely pay off.

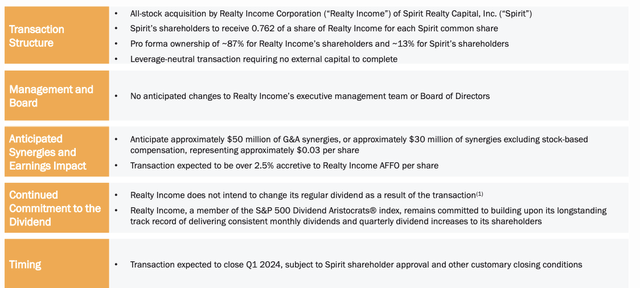

Realty Income Investor Presentation

The all-stock acquisition is costing 0.762 shares of Realty Income for each Spirit common share. It’s at a premium, but with Realty Income’s recent share price weakness as a result of the acquisition, the cost has come down. At the end of the day, Realty Income will own 87% of the combined company. The company expects a minimal $50 million of synergies total.

The company expects the acquisition to increase adjusted funds from operations, or AFFO, per share by 2.5%. The company expects the transaction to close Q1 2024, with an almost 7% dividend yield. It does not expect to change its dividend policy.

AFFO Opportunity

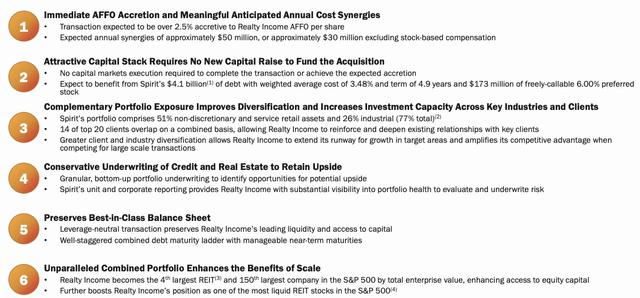

The company expects the transaction to add 2.5% to the company’s AFFO per share.

Realty Income Investor Presentation

The company is breaking out that AFFO per share into 3 categories. One-third is annual synergies, one-third is the low-cost interest rate debt versus market rate debt, and one-third is multiple potential. The multiple potential just highlights that Realty Income might be overvalued and is lost as a result of the acquisition.

The synergies and low interest rate debt are a real benefit, but minimal. It could also hurt the company if interest rates remain higher for longer and the company ends up with more debt overall that it needs to refinance. The company is chasing growth at all costs, but in our view, this is all a very expensive acquisition that might end up positive, but not by much.

Still, a lower-priced Realty Income would be interesting to us.

Realty Income Balance Sheet

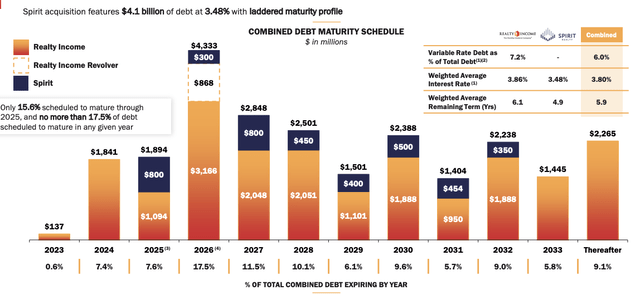

Realty Income continues to brag about Spirit’s $4.1 billion in debt at 3.48%.

Realty Income Investor Presentation

It’s true the debt is at a good yield. However, the company does have a substantial amount of debt. Combined, the company has debt with a weighted average term of 5.9 years at a rate of 3.8%. Overall, the company has a massive almost $25 billion in debt, costing the company almost $1 billion in annual interest expenditures.

At current interest rates, the company does have the risk of potentially getting $1 billion in additional interest expenditures, especially if rates remain higher for longer. The company’s almost $60 billion enterprise value is immense, and while its debt is backed by property, its balance sheet is a massive risk.

Option Investment

For those looking to invest in Realty Income, we recommend taking advantage of options. Please fully understand the risks of options before investing in them.

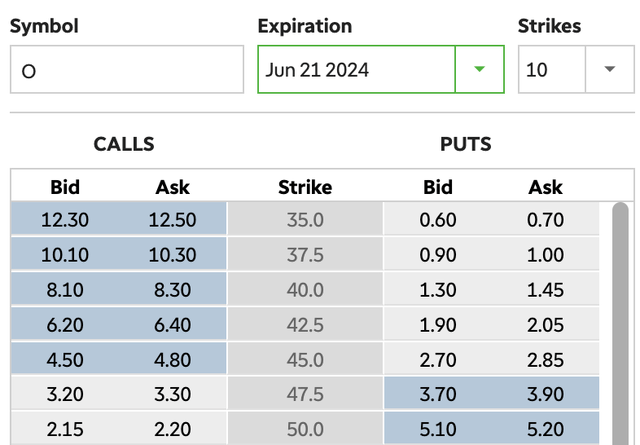

TD Ameritrade

Realty Income is currently trading at just under $47 / share. Selling a PUT option at $42.5 / share earns you immediately $2 / share. There are two scenarios that could happen here.

The first is that 8 months from now, at the expiration date of Jun 21, 2024, the company’s share price is above $42.5 / share. In that scenario, you keep the annualized 8% yield on your cash, a great deal. The second is the company’s share price drops below that level. That means at that point you invest at a breakeven of $40.5 / share.

That’s a dividend of more than 7%. That’s a much better time to invest.

Thesis Risk

The largest risk to our thesis is low inflation or a market downturn leading to a subsequent decline in the FED interest rates. That’ll cause the market to reevaluate Realty Income and its recent valuation decline, making the company’s share price appreciate. That’d hurt those who wait before investing in the company, as we recommend.

Conclusion

Realty Income has an impressive portfolio of assets. The company made a bad decision, though, by acquiring Spirit Realty, which will realistically only earn it ~1.5% in AFFO per share growth while having downside risk. The company seems more interested in becoming as large of a company as possible, taking growth by whatever means it can find it.

Rising interest rates have caused Realty Income Corporation’s share price to decline rapidly, increasing its dividend yield. The company has an almost 7% dividend rate. Using cash-secured PUTs at a lower price could enable a strong yield on cash or acquire the stock at a reasonable price. That helps highlight the company as an investment.

Read the full article here